Timeshare companies will report you to a credit bureau for stopping working to pay your charges. That can damage your credit. However if you don't care about your credit score, strolling away from a timeshare may be a feasible exit strategy. I just recently spoke with one reader who stopped spending for her timeshare in Southern California. She began by calling her business every month, requesting for a voluntary surrender, essentially using to quit the timeshare. A representative always decreased, describing that her timeshare was her duty for the rest of her life. Lastly, she overlooked the timeshare business's dangers to "ruin" her credit rating and just stopped paying her upkeep fees.

How did it even concern this? Who enabled these contracts that keep timeshare owners tied to a residential or commercial property they do not want or can't afford? And is there a method to make these arrangements fairer to owners, particularly at a time like this? Short of federal legislation to remedy the issue and override the state timeshare laws, which were heavily affected by timeshare lobbyists there's no other way to fix this problem. A federal law would also require to resolve the contracts retroactively, permitting owners a reasonable and sensible method to exit. That's extremely unlikely. Indeed, timeshare agreements are exceptionally unfair to many consumers.

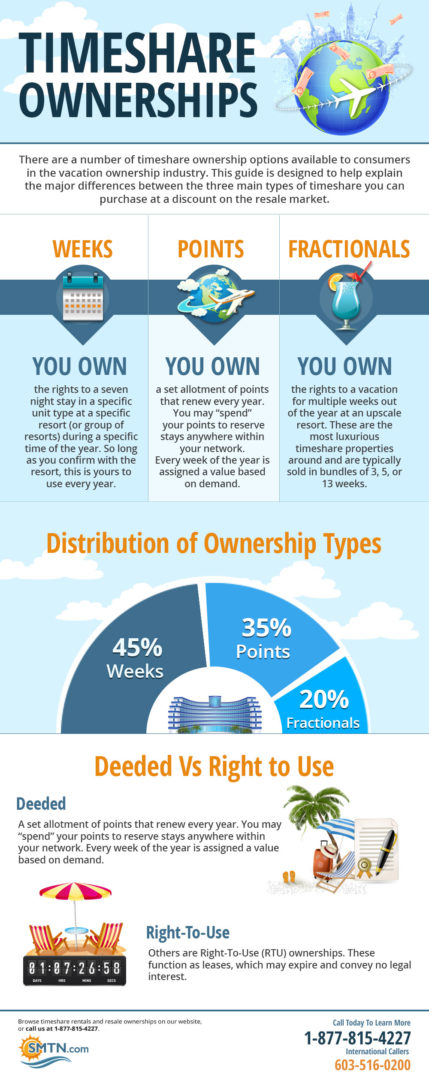

If you find yourself questioning how to buy a timeshare, you might be better off very first thinking of why. If you're a passionate vacationer that finds themselves traveling every year, a more irreversible getaway service may be ideal for you. Even if the idea of timeshares might be foreign to you, they stay an ideal vacation alternative for those who take pleasure in a lifestyle with regular travel. With countless present owners and countless high-end, luxury resorts to pick from, owning a timeshare can become a reality much easier than ever. However, with timeshare resales, you'll find a variety of affordable timeshares readily available in destinations in all corners of the world, permitting you to not only discover an easy service, however to find a long-term, budget-friendly service also. In Mexico, for example, immigrants are not enabled to hold the direct title to residential or commercial property within 30 miles of the coast and 60 miles of worldwide borders. They are restricted to "ideal to use" timeshares. (There is pending legislation in the Mexican Congress that might change that in the near future.) Also, customer protection laws in some nations are more lax and do not have enforcement. Still interested in buying a timeshare? Here are a few tips: When you consider devaluation, travel expenses and upkeep fees on top of an unpredictability of usage the concept of "prepaying" for your vacations may not pencil out.

Do you actually go to the same place at the exact same time every year? Or do you have a mix of activities and destinations, such as camping adventures, cruises, roadway journeys or arranged trips? If it's the latter, a timeshare isn't ideal for you. Timeshares diminish in value very quickly, so most banks The original source will not lend you cash to purchase them. Frequently, the designer will arrange financing for you, but at a much greater rates of interest than banks that do make the loans. What's more, typically in a foreclosure, the exceptional home mortgage balance and the unpaid upkeep fees are higher than the timeshare's value, which produces what is called a shortage. what is a timeshare in quickbooks.

What Does How To Write A Medical Excuse Letter For A Timeshare Do?

Another suggestion along these lines: it's a good sign if you are offered a grace duration allowing you to change your mind and cancel before committing to buying. This resembles a condo board, giving the home's owners a cumulative voice and strength in numbers. The owners' club may also be handy when you try to sell your system. You don't want any undesirable surprises when you show up for your trip. If so, you may wind up not using your timeshare system or points as much as you anticipate. Ron Kelemen is the author of The Confident Retirement Journey and a certified monetary organizer with The H Group in Salem, Ore.

Welcome to the "2-Minute Cash Manager," a short video function responding to money questions sent by readers are timeshares a ripoff and viewers. Today's question is about timeshares; particularly, if it's ever possible to get a bargain on one of these much-maligned getaway pads (what is a timeshare in quickbooks). I 'd wager timeshares are the source of more concerns I've overcome the years than any other. I can't count the number of emails I have actually received from desperate owners seeking timeshare cancellation lawyer to dump. That alone will offer a tip as to my opinion of these things. Watch the video with this post, and you'll choose up some valuable details. Or, if you prefer, scroll down to check out the full transcript and learn what I stated.